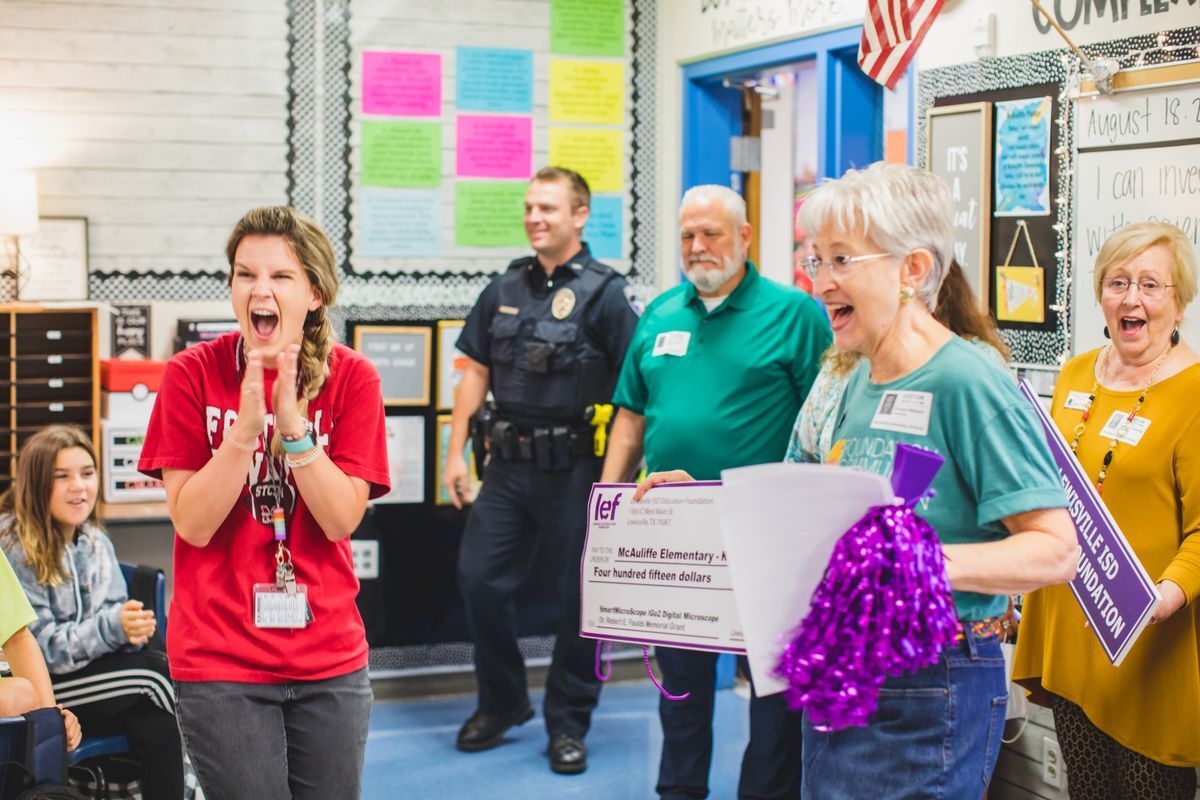

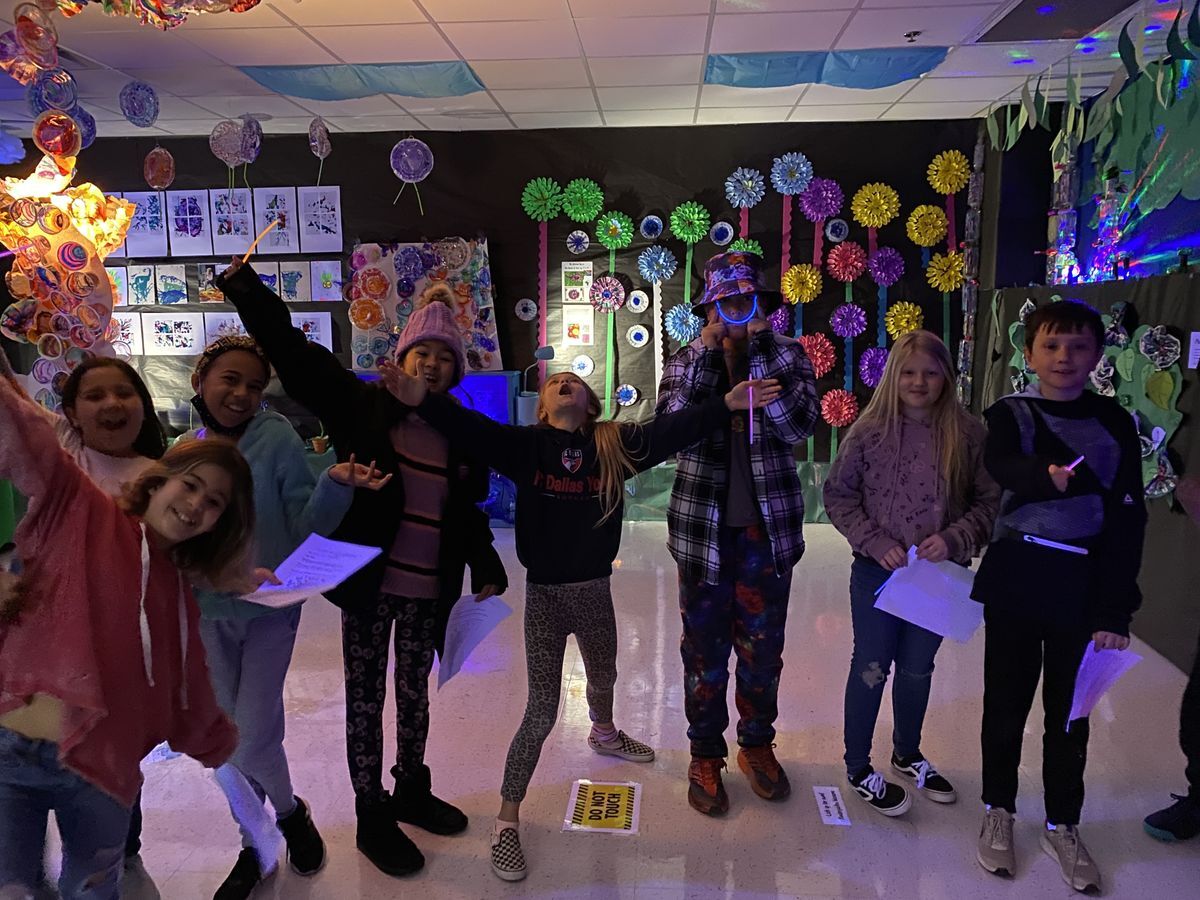

Every gift matters! Donate Today . . . To Make a Difference Tomorrow!

Operating on donations from businesses, civic organizations, and individuals, the Foundation is a careful steward of all monies raised and works closely with LISD to ensure that funds are distributed where they’re needed most.

Levels of Giving

The Foundation has been designated as a 501(c)(3) non-profit organization by the IRS. Donations made to the foundation are tax deductible as defined by the IRS Revenue Code.

For more information or to make a donation, please contact our offices at (469) 948-2022.